Is home mortgage interest deduction a good idea?

This is one of the most frequently asked questions at our live events. Below is my answer.

If you have a mortgage and are paying interest, it is ABSOLUTELY very important to take the mortgage interest deduction. BUT there are a few key facts to consider as well.

One thing I have heard commonly stated is “I am not going to pay off my mortgage early because I do not want to lose the mortgage interest deduction.” I believe this saying was initiated by banks because it is much more costly to keep the mortgage than to pay the taxes owed without the interest deduction. See the example illustrated below.

The Mortgage Interest Deduction

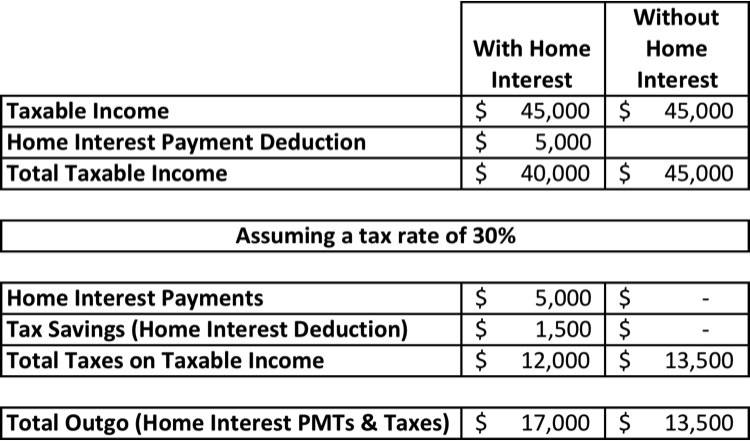

Let’s say you paid $5,000 in interest on your mortgage last year. By taking the deduction, you effectively reduce your taxable income by $5,000. You receive back the tax rate on that home mortgage interest deduction. If your tax rate is 30%, you will receive a refund of $1,500 because of the home mortgage interest deduction (30% of $5,000). Of course, the bank keeps the $5,000 you paid in interest. Uncle Sam receives 30% of your taxable income which is now $40,000 because you were able to reduce your taxable income by the $5,000 interest you paid. The total net OUTGO from your bank accounts to Uncle Sam and the bank is $17,000!

The Paid-Off House Scenario

Well, you are living life pretty good in your debt-free condition! You have paid off your house, so now you no longer pay interest to the bank (yay!). This means you will be taxed on your full income of $45,000. If your tax rate is 30%, the total net OUTGO paid to Uncle Sam is $13,500!

NET RESULT: By eliminating your mortgage, you have $3,500 LESS OUTGO from your bank account to someone else.